THE BUDGET SPEECH WHAT NOW & HOW CAN I SAVE ON MY TAXES?

The Minister of Finance release the budget for the 2020/2021 tax year, and it is as follows

Above inflation adjustment to personal income tax brackets. A small saving for South Africans, but can be some savings will be earned. Personal income tax brackets will be changed so that individual taxpayers will pay around R 2 billion less in income tax. The changes will mean that someone earning R 460,000,00 a year will see their taxes reduced by nearly R 3,400,00 over the next year.

The Plastic bag levy increases to 25 cents per bag. Which will actually place pressure on all consumers, but the author believes that this will mean that people may not actually end up purchasing more bags.

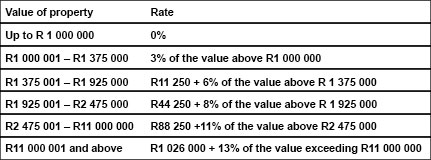

The largest surprise for the author is the increase in the Transfer Duty exemption to R 1 million. Along with adjustments to transfer duty rates. Which are now to be: (SEE ATTACHED)

Sunset clauses in respect of certain corporate incentives and a limitation placed on the use of assessed losses. This could be problematic for corporate taxpayers as assessed losses are a useful tool to reduce income or corporate income tax.

As usual, the general fuel levy increases by 16 cents per litre on 1 April 2020.

Allowable increase to tax-free savings increased from R 33,000,00 to R 36,000,00. Again small but significant, but the overall limit for remains R 500 000,00.

Finally, the increase of excise duties on tobacco and alcohol. Which means that the following will now cost more;

A 340 ml can of beer or cider will cost only an extra 8 c A 750 ml bottle of wine will cost an extra 14 c A 750 ml bottle of sparkling wine an extra 61 c A bottle of 750 ml spirits, including whisky, gin or vodka, will rise by R 2.89 A packet of 20 cigarettes will be an extra 74 c A 25 gram of piped tobacco will cost 40 c more A 23-gram cigar will cost an extra R 6.73

We did not see an income tax or VAT hike, all of which is welcome news.